Looking back, looking forward

Influencing product strategy through research for Shoppers Drug Mart Online Pharmacy

Qualitative research, quantitative data, research for impact

5 min read

In this case study:

The problem: Customer perspective and UX often get considered

after the high level product strategy gets set

What I did: Plan and lead a research study mid-year, in time to inform

decision-making for next year’s strategy

The results: Findings were incorporated in next year’s roadmap,

strategic planning and marketing campaign

What I learned: A few takeaways

Highlights

Product: Shoppers Drug Mart Online Pharmacy

Users: Pharmacy patients with ongoing prescription medications

Product by the numbers: 2.4M users/accounts, 3,600+ enterprise users

Role: Lead Design Researcher (on this study)

Other team members: Jessica Barrata (Design Research Lead), Tammy Le (Sr UX Researcher), Gloria Ip (Product Designer); Matthew Tsui (Quant Researcher); Help with fieldnotes and running customer interviews: Carmen Branje (Sr Product Designer), Rhodney Regoso (Sr Product Designer), Rosa Youn (Product Designer), Jason Wang (Product Designer), Rhiannon Milne (Research intern)

Timeline: 12 weeks

Sector: Healthcare, Pharmacy, Retail

Skills & methods: Qualitative research, Generative research, Customer interviews, Quantitative data

Tools: Aurelius

Artifacts: Research report, presentation decks

The problem

Online Pharmacy launched in 2017. As we moved through adding features and iterating on different parts of the experience, all the customer insights I collected were narrowly focused on each problem at hand. Meanwhile, our customer base has grown exponentially over two years.

I have also been through a few cycles of roadmapping over the years. It made me realize that by the time we start thinking about next year as a team, it is already too late to do any kind of insights work.

We were overdue for a more in-depth inquiry. I initiated this research study, so that the wider team across business, marketing and product has a foundation of customer insights to use going into next year’s planning.

Online Pharmacy includes a prescription medication dashboard, text message notifications and expedited pick up at store

What I did

I planned and led a research study mid-year to inform decision-making for next year’s strategy.

My role

I initiated and led this research study, handling everything from research planning, recruitment, fieldwork, analysis and synthesis, and sharing the findings. I leaned on Jessica Baratta, our Design Research Lead, for guidance throughout. I was also ecstatic when Tammy Le joined our team as a Senior Researcher partway through this study and could help me with synthesis and sharing the findings.

Our starting point

We were very fortunate with product market fit. It was evident in our high customer satisfaction (OSAT) score and continued, largely organic growth. However, we didn’t fully know why customers appreciated our product so much. What jobs did they hire our product to do? What were their unmet needs?

The broad research question I started with was: What do our current customers value most about our products & services?

Bring me only questions

I collected more specific research questions from the 12-person team involved with our product.

Research questions from the wider team, including marketing, product management, business and strategy.

I then analyzed each question to determine the best research methodology to answer it. I used three main sources of data: one-on-one interviews with 20 customers nation-wide; usability testing with 12 customers, and quantitative data from multiple sources.

I analyzed each question to determine the best research methodology to answer it

Remote participation

I opened up the remote interview sessions to anyone on the wider product and business team. I did some priming on what to expect from live research interviews.

This proved to be so simple and yet so impactful (almost cathartic!). For some team members it was their first direct exposure to our customers and to qualitative research.

Remote customer interview sessions. I handled the recruitment myself, so that we could focus on specific types of customers with laser precision.

Prompts and trigger cards used during customer interviews to explore feature ideas and nomenclature.

We collected 2,100 min of footage and 1,200 data points in Aurelius

Looking at quant data

Next we needed to answer some of the research questions and validate our qual research findings on a larger scale. I relied on an array of quant methods: analytics, A/B testing, customer feedback analysis and a market research survey.

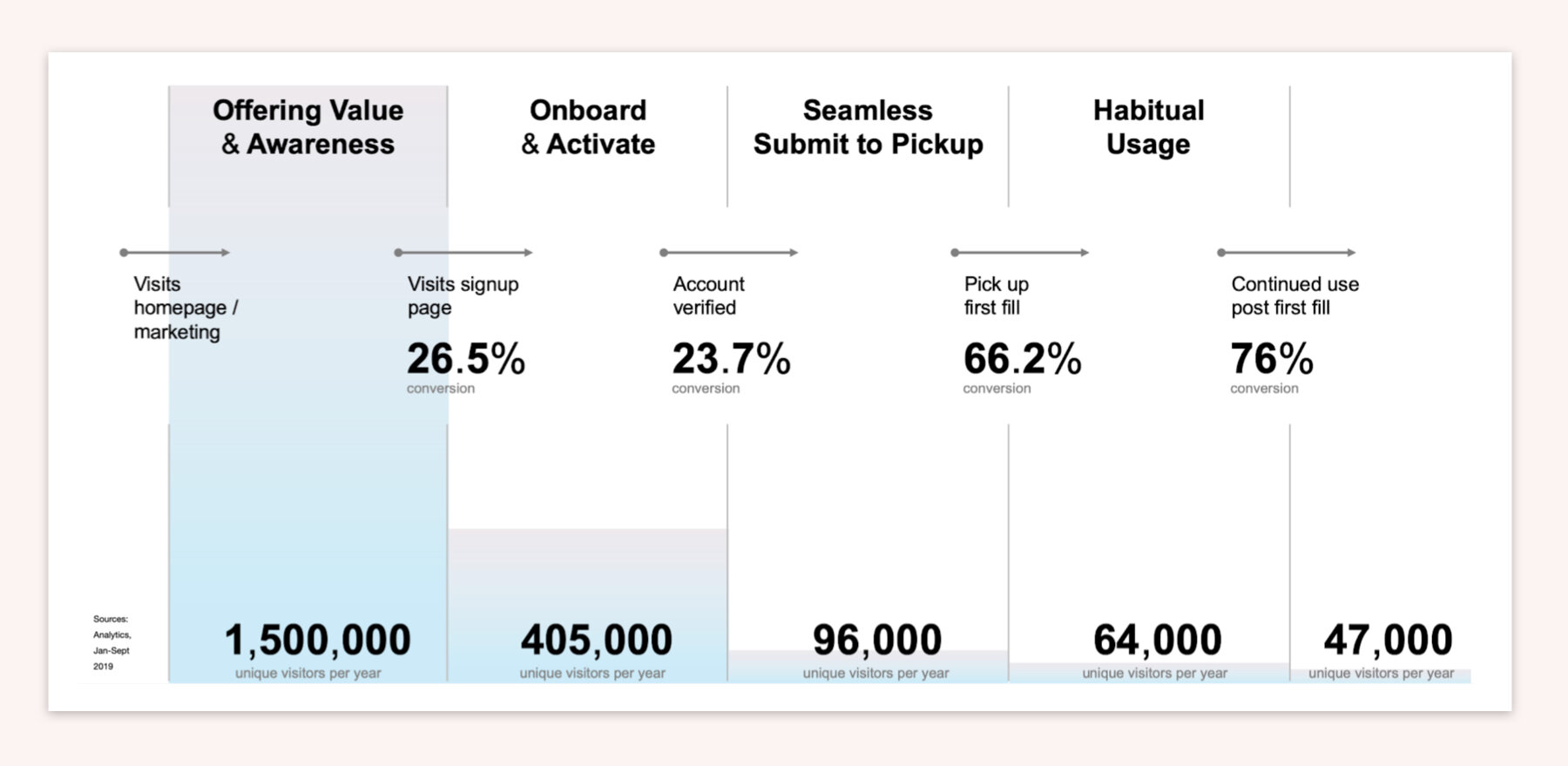

Analytics for different stages in our customer lifecycle funnel

Multi-variant testing to explore various marketing value props

Some of the product and feature ideas shown to customers in the market research survey exercise

Customer interest in product and feature ideas from the market research survey

Research findings and early impact

This research study was very robust. We ended up with findings that shed light on all the 58 research questions we started off with. I will highlight two interesting findings here.

One area along the customer journey that showed up the weakest was awareness of the service and of specific product features. We were able to provide guidance on what marketing language resonates more with customers, and what questions they want to have answered. All of this information was taken into account in creating next year’s national marketing campaign.

Research insights mapped along the customer journey

The research study informed the language and messaging of the national marketing campaign

An interesting research finding was that our customers valued saving time above all other benefits that our product offered. (Up until now our team focused on services that helped ease mental load, as opposed to save time.) For example, out of 20 feature ideas shown to customers, ability to submit a new prescription online was preferred by a high margin. This feature is now undergoing feasibility and regulatory assessment.

Not just another research study

My main objective was to ensure that our wider team uses the insights we uncovered to inform their decision-making. The findings had to resonate deeply and remain memorable for people over the months to come.

Tammy Le, Gloria Ip and I planned and ran two large research shares for the wider team. I used gamification to make the share more fun and personal. We called out who asked a research question, discussed the findings and doled out chocolate coins as rewards. To make the insights feel authentic, we showed video clips from customer interviews. I got a lot of positive comments after sharing research insights (“The share was spectacular!”).

We used gamification and videos to engage two dozen team members across the business.

Presentation structured around research questions from the team

I also set up smaller meetings with key decision makers on the product (the general manager and head of product management for the business). This helped me get in their jam-packed calendars and present a tailored narrative.

Results

A seemingly small, but important, win for me was to expose the wider team to our customers firsthand. This study also helped the team see the value of conducting in-depth strategically-focused research inquiries. The insights influenced the national marketing campaign. The findings also provided a starting point – and a foundation – for next year’s product strategy.

Lessons learned

I saw how important it is to be proactive and initiate customer research at the right time to help the wider team make decisions.

Just in time

Planning ahead for this research study has really paid off. Organizationally, Loblaw has many sources of gaining knowledge about our customers. Beyond conducting qualitative research, my main contribution was playing the role of a team connector. I helped get insights from many sources available at our fingertips at the right time to inform decision making for the wider product, business and marketing teams.

Hitch a ride to get there faster

Serendipitously, in the middle of the study I learned that another team within Loblaw’s vast business was commissioning a survey to explore customer interest in new digital health-related services. I used this opportunity to add on to their survey and save my team – and the company – the cost of duplicate research efforts. This additional opportunity to validate findings on a larger scale through quant methods helped make the study much more robust.