How the

sausage is made

Strategic work for the new Loblaw e-com Marketplace

Strategy, facilitation, research

3 min read

I was part of a cross-functional team tasked with enhancing the 3-year strategy for Loblaw’s new e-commerce marketplace. We ran an 7-week sprint that culminated in presentations to the Loblaw management board, and ultimately led to new investment allocated to bringing our ideas to life.

I learned a lot about how strategy gets set at scale for the largest Canadian retail company.

In this case study:

The problem: Strategy enhancements for a product that hasn’t yet launched

What I did: Facilitation, research & crafting the final pitch

The results: Executive buy-in and investment in new ideas that came out of

cross-functional collaboration

What I learned: A few takeaways

Highlights

Product: Loblaw e-Commerce Marketplace

Users: Canadians shopping online for non-grocery items, with the main focus on “busy providers” (main planners/caretakers in families)

Role: Facilitator & contributor

Other team members: Herman Paek, Nicolas Petrera, Karmun Lau, Andrew Fransen, Farzeen Saleh, Michael Sweleba, Kim Phelan, Amy Chan, Hesham Fahmy, Zoya Raza, Shelley Tangney, Victor Lu

Timeline: 7 weeks

Sector: Retail, e-Commerce

Skills & methods: Facilitation, Qualitative research, Generative research, Customer interviews, Design thinking, Pitching

Tools: Aurelius

Artifacts: Presentation decks

The problem

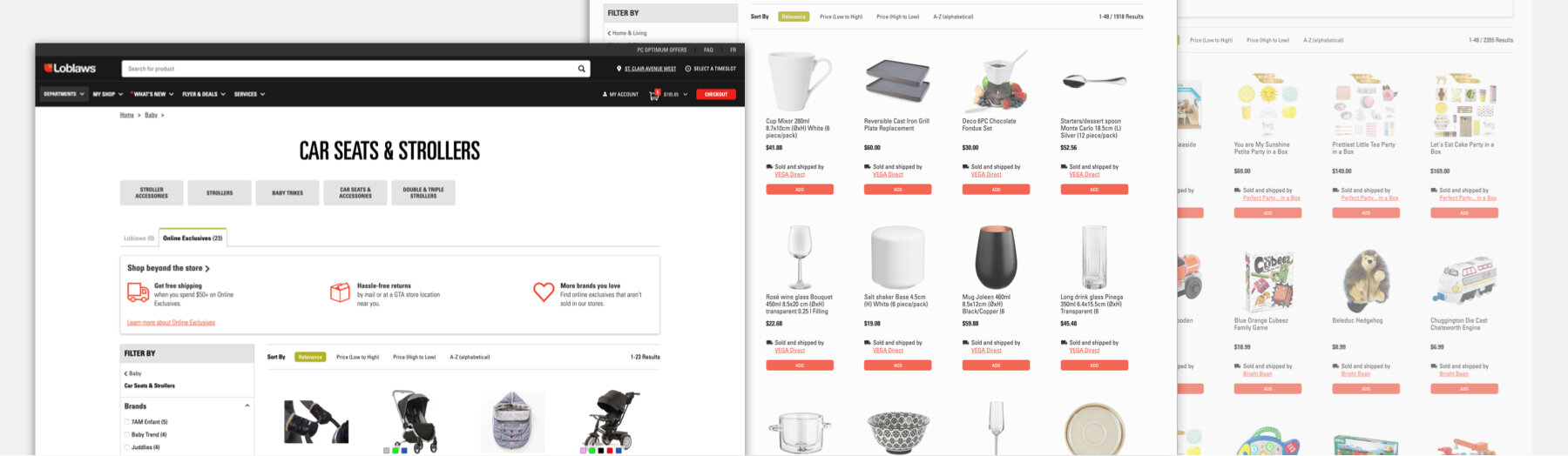

Loblaw Marketplace lets customers buy a wide new selection of non-grocery products online. You can buy anything from a stroller to furniture. The products are fulfilled by Loblaw or third-party sellers.

Our focus was to find ways to capitalize on other areas of Loblaw’s vast business in innovative ways to raise awareness and enhance customer experience for this new product.

Marketplace was due to launch later in the year. Our main challenge was that there was no quant data available yet to inform our decision making. What do customers think about the product selection? How is their user experience? Do people even know they could buy all these products from Loblaw online?

Some examples of products customers could purchase on Loblaw Marketplace after launch

What I did

I facilitated ideation workshops, conducted research & helped craft the final pitch.

My role

My role was to facilitate discussions, provide a framework for ideation, bring in the customer perspective through research and help structure our final thinking in an effective deck. Our 12-person team covered expertise in retail, banking and loyalty, as well as finance, marketing, product management, data science, technology and strategy.

Starting off with the customer lens

I ran a workshop guiding the team through creating an assumptions-based customer journey for a Marketplace online purchase. I’ve included returns and other “unhappy paths”, because it was important to consider how to maintain – even deepen – the relationship with the customer when things go wrong. This process helped everyone get into the headspace of thinking from customer perspective before focusing on financial targets. It also capitalized on the deep expertise of everyone in the room. We came out of the session with some areas of focus along the journey that we wanted to explore further.

A workshop I ran to help the team think through an assumptions-based customer journey.

I surfaced existing customer insights to help inform our thinking.

Informing our thinking through research

The next step was to validate some of our hypotheses with our customers. I teamed up with research powerhouse Jessica Baratta, research intern Rhiannon Milne, and Senior Director of User Experience Liam Thurston. We ran a lightning-fast research study, conducting 90-minute-long interviews and co-creation sessions with 20 customers.

In under 2 weeks we finished research planning, recruitment, fieldwork and pulled insights from over a thousand data points in Aurelius.

Based on the research findings, we isolated three main customer pain points to focus on. We also identified which areas of the enterprise could help us address these pain points for our customers.

Three customer pain points that came out of our research that we chose to solve for

Three cycles of ideation

I planned three ideation workshops to come up with the “meat” of our pitch. With multiple cycles of ideation, each team member had a chance to marinade on some ideas over time and be exposed to a workshop framework that better suited their thinking style. Some people prefer more structure, some need a lot of quiet thinking time, others jump at a chance to spitball out loud in real time.

I also had some techniques to mitigate the “HIPPO effect” (where the highest paid and most senior person in the room may inadvertently influence the discussion too early). I mixed up the groups for each of the workshops. And when it came time to converge on our top ideas, I made the HIPPO vote last.

Ideation structured around our desired key results and which areas of the business can help us get there

Ideation around the customer life cycle

Ideation based on latest trends in and outside of the industry (Air BnB-inspired "orthogonal thinking)", customer insights and ideation trigger cards. During this workshop we also converged on the final ideas.

Final strategy

This is an emergent area of the business. I am not at liberty to share our final ideas at this time.

Showtime

The remaining work was to craft the final presentations as a group. For the short pitch deck, we loosely adapted Guy Kawasaki’s 10-slide pitch format. I included a video compilation from customer interviews in the deck. This proved to be a very effective way to tie our thinking back to customer problems. It also exposed the management board to more real people who shop at the many online and brick-and-mortar Loblaw company stores.

The final deck included a video compilation from customer interviews

Results

When you set strategy for a product that hasn’t launched yet, it isn’t possible to measure quantifiable results right away. We would have to wait for a few years to see some of the ideas come to life. Even then – as anyone in a strategic function knows – a lot depends on execution and the shifting business context.

Instead, I define success for this project as learning and collaboration. Everyone on our 12-person team learned from each other, had a voice and made a major contribution. We also got executive buy-in and a new investment allocated to bringing our ideas to life.

Lessons learned

I learned to embrace the messiness of setting strategy for an emergent business. I also got exposed to a much larger context of how decisions get made in a large multi-billion dollar business, and where product design fits in.

Embrace the mess

Strategy and ideation for an emergent business isn’t a linear process. Sometimes it feels like you are taking two steps backwards before you can move forward. This project taught me to embrace uncertainty, get comfortable with changing outcomes and repeatedly reframe my thinking.

Zoom out

The most exciting aspect of working for Canada’s oldest and largest retailer is SCALE. Loblaw has tens of thousands of employees, billions in sales, and thousands of stores across the country. My role and expertise is very niche in this context. On top of that, my personal challenge as a maker and a craftsperson is that I often get bogged down in smaller details. I got exposed to big picture thinking through meetings with C-suite and management board members and through collaborating with my cross-functional team. It made me see – and internalize – a very different perspective of how decisions get made at scale.